results-based

inventory

GGF provides continuous stock to distributors who perform on their credit portfolio. The not-for-profit facility aims to stimulate local economic development while mitigating carbon emissions.

GGF ENSURES SOLAR DISTRIBUTORS GET SWIFT ACCESS TO INVENTORY

GGF is a not-for-profit facility that ensures the replacement of fuel generators - stimulating local economic development while mitigating carbon emissions. It provides stock to solar generator distributors to boost their sales. GGF provides technical assistance and digital loan portfolio management tools to distributors, rewarding best business practices.

features & benefits

fast access

through lean due diligence

low transaction costs

due to not-for-profit facility design

small initial tranches

scaling over time based on results

portfolio monitoring

to build track record

highlights

Small amounts and fast-tracked approval process

GGF drastically reduces the barriers to access financing for solar distributors thanks to lean, fast and efficient due diligence focused on sector specific metrics. It provides companies with payment terms on inventory up to 24 months.

data builds trust

GGF gathers data points to establish track records and build investor confidence through Prospect. This approach helps create a pipeline of capable distributors while fostering the growth of top performers.

scaling amount over time - based on results

Traditional financing provides companies with large tranches to buy inventory, pushing them to sell quickly. GGF, however, finances only the stock needed, allowing distributors to focus on quality sales and grow their business steadily at their own pace.

carbon finance gradually replacing grants as a first-loss cushion

The detailed monitoring of systems allows to measure and trace the carbon savings from fuel displacement. The monetization of these carbon savings provides the first loss layer necessary to de-risk the facility and lower its cost of capital.

Why GGF?

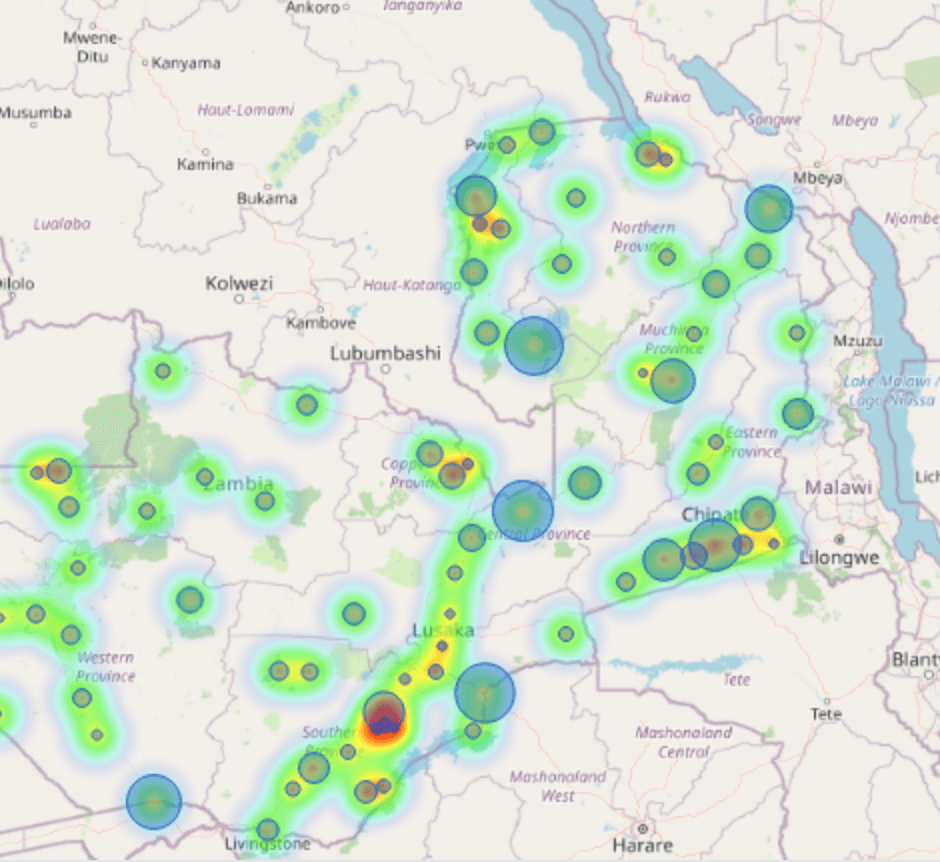

scaling the solar market is possible

The demand for larger solar systems is high, especially in off-grid and weak-grid areas.

Affordable and reliable solar technology is readily available, with a growing number of suppliers entering the market.

Furthermore, creditworthy distributors are actively engaged and eager to deliver high-quality solar products.

financing remains main bottleneck for growth

Smaller distributors face high barriers to access financing due to a combination of • missing track record • complex and lengthy due diligence • high transaction costs

The lack of financing limits the availability of stock, resulting in low adoption rate and limiting market growth.

GGF aims to reduce these complexities through lean, digital processes.

impact | for people, businesses & the climate

- In Nigeria alone, approx. 20 million small fuel generators emit around 50 million tonnes of CO2 per year

- For every solar generator installed, 15 tonnes of CO2 are mitigated over 5 years

- Customers of solar generators save an estimated 1,700 USD over 5 years compared to a fuel generator; businesses are empowered by efficient, reliable energy supply

- Improved health of business owners and staff through avoidance of pollution and noise

- The energy transition creates new green jobs for solar installation and maintenance technicians

our team | bringing together financial and operational expertise

Our team has a wealth of experience in green investments and development finance across both private and public sectors. With over a decade of hands-on experience in the off-grid solar industry—managing sales, operations, and customer loan portfolios—the team possesses a strong, practical understanding of the sustainable energy access sector and its challenges meeting SDG7. GGF is passionate about accelerating the solar revolution and providing sustainable energy access while creating green jobs and mitigating climate change.

the investment committee

scaling the market for all distributors

GGF is supplier agnostic and open for all solar products that are Verasol or IEC certified. GGF’s initial product scope is focused on solar generators with an intention to expand to other product segments.

Endorsed by